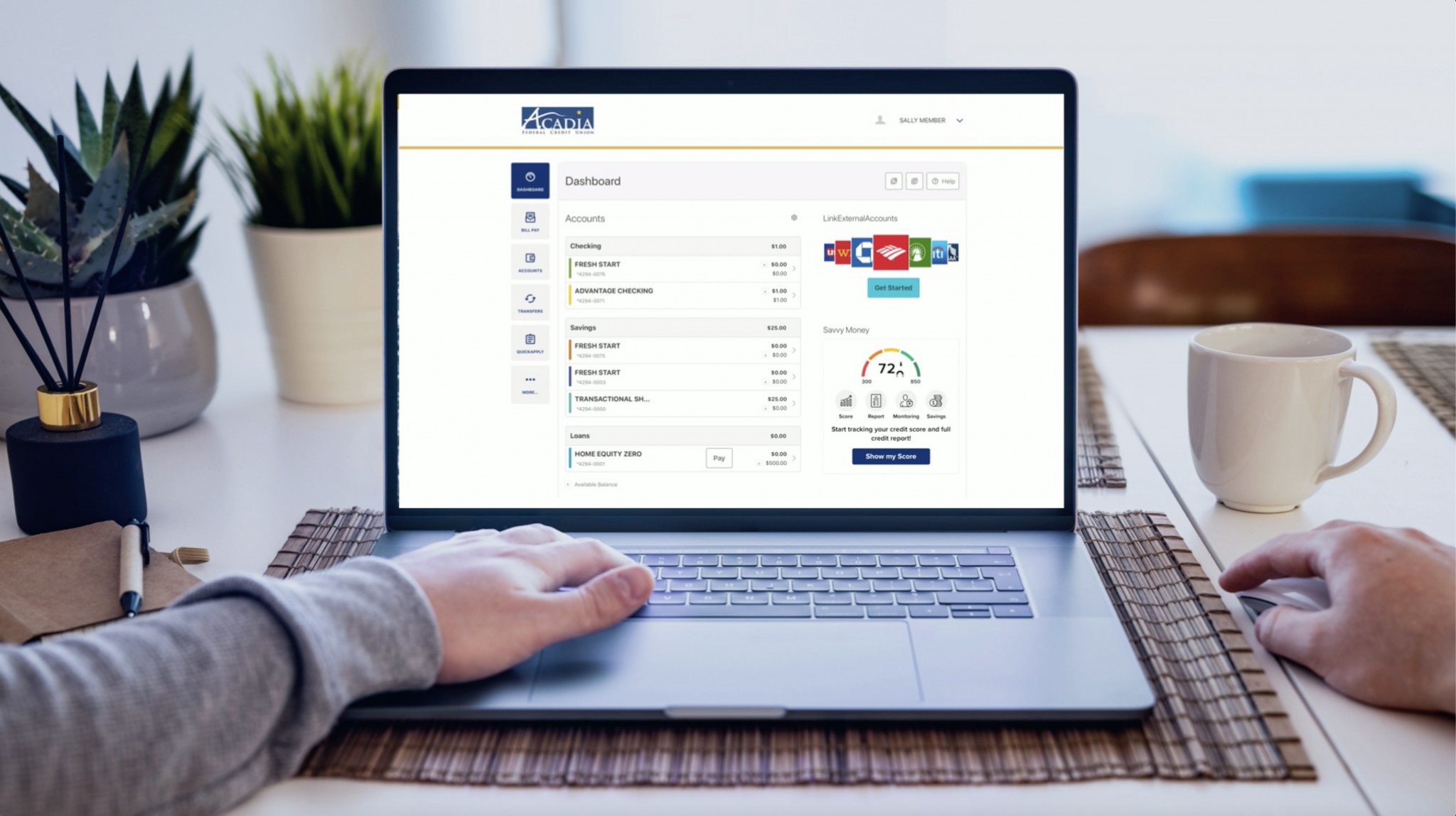

Digital Banking with Acadia

Acadia's Digital Banking Experience offers the ultimate in speed, security, and evolving functionality, with all the features you would expect and more!

Acadia's Digital Banking Experience offers the ultimate in speed, security, and evolving functionality, with all the features you would expect and more!

Take a tour of the login process of our Digital Banking Experience (launched in August of 2022). See for yourself just how easy it is!

Go ahead and use the ‘LOGIN’ button at the top of this page and follow the steps.

We highly recommend you keep your account information up-to-date. You may do this in a variety of ways. Call us at 1-855-692-22345; use our Secure Message Center within digital banking; click Live Support in the bottom right corner of this page; OR, or you may do it yourself. In order to make these account changes yourself, visit this page with step-by-step instructions. It’s quite easy!

Some call it Home Banking, others call it Online Banking, but in 2021, we evolved our online platform into a multi-faceted, feature-rich experience that puts YOU in control. We are proud to offer Digital Banking and you can learn all you need to know right here!

It’s super-easy! Just take the time to read each screen as you make your way through – follow the steps. You may also take the guided step-by-step registration tour right here, just to see what it’s all about before you begin. If you have trouble, please contact us by clicking the Live Support bubble in the lower right corner of this screen or by calling 1-855-692-2234. We’re happy to help in any way we can!

If you are a joint owner on an account, you can log in with your own username and password, separate from the primary account owner’s log in credentials. Register using your own SSN and email and you will have access to all accounts your Social Security Number (SSN) or Employer Identification Number (EIN) are associated with. If you don’t see an account that you’re on and would like to, don’t hesitate to contact us.

Yes, you have the ability to unlock yourself after hours, without the help of an Acadia FCU staff member. Our Digital Banking is meant to be self-service, for those who prefer a hands-on approach! Clicking either “forgot username” or “forgot password” will offer guided steps and two-factor authentication to allow for a member-controlled unlock, even after you’ve failed all five attempts to log in.

Please keep in mind that the information needed to authenticate your account needs to match exactly what Acadia FCU has on file for you. For example, using a different email address, zip code VS zip code +4, or a typo on file with your email address could cause your account authentication to fail. Please confirm your account information with us if you have any issues unlocking your account.

Acadia FCU members can opt-in to “Credit Score,” a comprehensive credit score program, powered by Savvy Money, offered for FREE! You can now closely monitor credit activity using without negatively affecting your score and stay on top of your credit. You’ll learn about what’s impacting your credit score and how you can improve it. Furthermore, “Credit Score” will alert you of any major changes or suspicious activity on your credit report. Find out everything you need to know about “Credit Score” in this article.

Yes – if you enroll for texted fraud alerts, you will receive a text from our offsite fraud center to approve or deny a suspicious charge. Sometimes, these transactions are actually legitimate and your debit card gets blocked when it doesn’t really need to be. Learn more about this service here.

Acadia Smart Card can be activated within our mobile app, AcadiaGO. You can read the full article or see these quick steps to turn it on:

How to Get Started

Acadia Smart Card can only be used by AcadiaGO mobile app users. From your AcadiaGO app, follow these steps:

Once you have Acadia Smart Card set up on your device, you can access your card controls anytime by navigating to Smart Card using the same steps listed above.

Note: You will see the Acadia Smart Card app icon on the home screen of your device, but you may continue to access the app via the AcadiaGO menu.

If your device is set to automatically update, it should happen seamlessly. If auto-updates are not enabled on your device, you will need to manually update the app.

How can I update to the latest app?

Once a new version is released, you may follow these steps:

For any Android device:

1) Open the Google Play Store

2) Tap the three horizontal lines in the upper-left corner of the screen

3) Tap “Settings”

4) Tap “auto-update apps”

5) A pop-up window will ask you to select the your auto-update preference, then select done.

If you do not want to have automatic updates, but need to manually update the application, you would need to:

1) Open the Google Play Store on the Android device

2) Tap the three horizontal lines in the upper-left corner of the screen

3) Tap “My Apps & Games”

4) You can update all their apps or tap our application to start the update

For any iOS device:

1) Open the “Settings” app on your iOS device

2) Tap on “App Store”

3) Toggle on “App Updates” to turn on automatic app updates

If you do not want to have automatic updates, but need to manually update the application, you would need to:

1) Open the “App Store” on the iOS device

2) Tap your user profile icon in the upper right corner

3) Scroll down to “Available Updates”

4) Tap “Update” next to our application to update only our app or tap “Update All” to update all of your applications

We’re sorry if the chat bubble gets in your way sometimes, but you can actually move it. Just tap and drag to a new location on your screen. You can’t shut it off, but moving it to a new spot should help.

Online banking is any form of personal banking which you conduct using the Internet – many of you do this already. While online banking only deals with the essential transactions – the nuts and bolts, Digital Banking goes much deeper – more “big picture” and requires a comprehensive re-engineering of Acadia’s internal systems. Online banking is essentially one facet of Digital Banking, since Digital Banking expands beyond the nuts and bolts and simple actions of online banking by offering increased mobility and feature-laden transactions.

In a nutshell, it’s what you’re already doing, but WAY better!

Acadia FCU is committed to providing technology to help our members better manage their finances. This upgrade modernized our digital infrastructure, offering the ultimate in speed, security, and evolving functionality – providing an improved experience compared to what we offered in the earlier days of digital banking.

Our upgrade in late 2021 brought users:

It is our pleasure to present our members with a seamless experience, making your Digital Banking experience with Acadia FCU the best that it can be!

You will need to know your username, email address, and zip code. This information must be the same as what we have on file, so please be sure your most current information is in your account. Please call 1-855-692-2234 or click the Live Support bubble in the lower right corner of our website to verify your information or if you do not know your current username.

No. If you are the primary account holder, your online banking account will carry over and you will be able to log in with your existing username. You will need to create a new 10-character (or greater) password. Click here to see step-by-step instructions.

Yes, you will need to create a new password with minimum of 10 characters. If your current password already meets the new password requirements, you’ll still be able to use it. Bonus: Going forward, you’ll only need to change it once per year!

Some of our suggestions regarding creating your new, minimum 10-character password are:

Also known as your share account number, this number can be found on the member ID card you received upon opening your Acadia FCU account. You may also find this number on the top right-hand corner of your monthly statement. Your membership account number is NOT the long number located at the bottom of your checks – that is your MICR number.

Your MICR number is the long number located at the bottom of your checks and is used for setting up direct deposits and automatic withdrawals from your accounts. This is not the same as your account number.

If you are the primary owner of the account, your name will appear at the top of your monthly statement, and any joint owner will be listed at the top of the “Statement Detail” section.

Yes. You will have to set up that member in your transfer options. Click “Transfer to Another Acadia FCU Member.” Once you enter their name, account number, and share ID and select “Save Account for Future Use,” you will be able to transfer funds now – and in the future – without needing to re-enter the information. If it’s a one-time transfer, simply do not “Save Account for Future Use.”

If there is an account you are not seeing, please contact us using the “Live Support” in the lower right corner of this page or by calling 1-855-692-2234. We’ll be happy to assist.

If you currently use Bill Pay and are the primary account holder, all account information will carry over. We plan for a seamless transition! If by chance your Bill Pay info doesn’t seem quite right, please contact us by clicking “Live Support” in the bottom right corner of this page or by calling 1-855-692-2234 and we’ll help you out.

The current version of AcadiaGO will be disabled after launch day and you will need to download the latest version. Please read this article with step-by-step directions on how to update your app.

Yes, you will be able to enable biometrics for sign in purposes if you wish.

Yes, you can access Digital Banking using any of the supported browsers (within the two latest versions): Google Chrome, Microsoft Edge, Firefox or Safari.

You may click on either “Forgot username” or “Forgot Password” and follow the steps, anytime of the day or night. You may also click “Live Support” in the lower right corner of this page or call 1-855-692-2234 and we’ll be happy to assist you in obtaining that information.

If you are currently enrolled to receive eStatements, you will find them in the eDocuments widget. If you are not currently enrolled to receive eStatements, simply sign up through the eDocuments widget, located within the “More” widget on the left sidebar

You can, but you’ll need to have that feature enabled on your account. To get the ball rolling, simply click “Transfers” and then “Add External Account (ACH)” and follow the steps to complete setup. When you attempt your first external transfer, you will receive an error message stating you have exceeded the $0.00 limit. At that point, you will need to reach out to our Support Center by clicking the Live Support* bubble in the lower right of your screen or calling 1-855-692-2234. We will then send a DocuSign form your way to determine your external transfer eligibility. This is a security measure that is in place to protect our members and you will only need to take this extra step the first time.

Business accounts are treated differently as we can tailor ACH accounts individually.

*Live Support is open during regular business hours. If we are closed, you may leave a message right there and an agent will contact you during the next business day.

The routing number is located at the bottom of the page from your desktop computer or if you’re using a browser from your mobile device. AcadiaGO mobile app users will find the routing number within the “more” widget. Acadia FCU’s routing number is 211287748.

Select your loan and click “Pay” for loan payment details.

Click on the “Transfers” widget, select the account the transfer will come from, and the account it will go to, then type the amount of the transfer. Enter the rest of the relevant information such as the beginning date frequency and end date. Confirm the transfer and you’ll receive confirmation that it was successful.

Quickbooks users have a seamless sync between their Acadia FCU transactions and Quickbooks software. It works like a champ!

Same goes for Quicken — Acadia FCU members can enjoy a direct connection between Acadia Digital Banking and Quicken, pulling transactions into the popular personal finance software with no additional steps needed.

Please note, if you were using Quicken prior to our upgrade to Digital Banking in August of 2021, you may still have an old account synced with your Quicken and need to update to choose the newer one. Within the Quicken software, you will see two instances of Acadia listed in the list of financial institutions. You will need to select AcadiaFCU MAINE in order to properly sync transactions. Remove the old account and then add the newer AcadiaFCU Maine in its place.

If you are having issues with this process, please check here for help or contact us using the Live Support bubble at the bottom right corner of your screen during business hours. One of our friendly Support Specialists can help you through video, audio, phone, or text chat.

(Updated 3/17/2022)

You certainly can! Widgets are customizable from “Widget Options” on your desktop computer or under “Navigation” if using the AcadiaGO mobile app.

When you select “hide an account,” it is hidden from your dashboard and the accounts widget. The only way you will be able to view it is when you click on “Settings” and then “Accounts”. Accounts that are hidden can be changed at any time.

Yes, you certainly can. This secure channel makes it one of the best ways to send any questions or documents that include sensitive, personal information. Read this article to learn how it works!

All account nicknames and colors are customizable with this upgrade by going to “settings” and then “accounts.” Changing the account name and color code makes it super-easy to quickly identify accounts, especially for anyone who has multiple primary or joint accounts.

On a desktop PC or if you’re using a browser on a mobile device, simply select the account name you want to change, then click the pencil to the right of the name. Change the name and/or color, then select “Save.”

From the AcadiaGO mobile app, click “more” in the lower right corner, then select “others” from bottom of the menu, then choose “settings.” Click “accounts,” then select the account you want to change, and click the pencil to the right of the name to make the changes. Don’t forget to click “save” in the upper right corner.

You sure can! It’s never been easier to keep track of all your accounts with financial institutions, even if all you have with them is a credit card! When you link your accounts, you will have a safe, secure, and efficient way to view your personal finances. You can link investments, bank or credit union accounts, credit cards, and bills. Read more about this great feature right here.

You sure can! Remote Check Deposit is one of the many great features we offer in our Digital Mobile Banking. Read more about this great feature right here. Please note, you must use our AcadiaGO mobile app to perform remote check deposits. This feature is not available when you access the web version of our Digital Banking platform.

Yes we do! Please click on the Live Support bubble at the bottom right corner of your screen during business hours. One of our friendly Support Specialists are ready to assist you through video, audio, phone, or text chat.

Yes we do! Our mobile banking app works on Apple, Android, or Kindle. Visit here to get Acadia’s mobile app.

ACADIA FEDERAL CREDIT UNION

MOBILE REMOTE DEPOSIT AGREEMENT

Acadia Federal Credit Union, a federal credit union, and “Member” as defined below, hereby enter into, as of the date the Credit Union grants access to the Services (the “effective date”), this Mobile Remote Deposit Agreement (“agreement”). The agreement consisting of general terms and conditions, exhibits, and any amendments attached hereto or hereafter by mutual consent of the parties, and incorporated by this reference.

Mobile Remote Deposit Capture

General Terms and Conditions Agreement

This agreement establishes the rules that govern the processing of deposited checks through member’s account(s) at the Credit Union using Mobile Remote Deposit. From time to time, the Credit Union may amend any of the terms and conditions contained in this agreement. Such amendments shall become effective as stated on any notice sent to you, the member. Examples of such notices might include, but are not limited to, newsletters, disclosures, etc. By using the Mobile Remote Deposit, you accept all the terms and conditions of this agreement. Please read it carefully. The terms and conditions of member’s Membership Agreement and the Truth-In-Savings Schedule for member’s deposit accounts and each of member’s loan agreements continue to apply notwithstanding anything to the contrary in this agreement.

Rules, Laws and Regulations

You agree to abide by and comply with all local, state, and federal rules, laws and regulations. These rules include but are not limited to Regulation CC “Expedited Funds Availability Act”, its Subparts B, C and D (Subpart D implements the Check Clearing for the 21st Century Act (Check 21 Act). The Bank Secrecy Act (BSA), and laws administered by the United States of America which are in existence as of the date of this agreement and as amended from time to time.

Definitions

In addition to all the other terms defined herein, the following terms shall have the following meanings:

Services and Funds Availability

Once approved for the Mobile Remote Deposit program, you may use the services to deposit checks into your account(s) with the Credit Union, subject to the terms of this agreement. Checks deposited through the services will be converted to image items for processing. The services are subject to transaction limitations and the Funds Availability Disclosure, as set forth in the Membership Agreement and Truth-In-Savings schedule, which govern the use of your account. We are notifying you in advance that deposits made by the Mobile Remote Deposit program do not fall under the standard provisions of Regulation CC – Expedited Funds Availability Act. As such, longer hold periods may apply. You agree to receive notice of extended hold times via the e-mail address provided in your Account Application. The maximum single Mobile Remote Deposit is $100,000. Local checks made through the Mobile Remote Deposit program will generally be available according to the following scenario:

Local check Mobile Remote Deposit $100,000

• $225 made available on the first business day

• $5,525 made available on the third business day

• $94,250 made available on the seventh business day

Returned Deposits

Any credit to your account using Mobile Remote Deposit is provisional. If a check deposited through Mobile Remote Deposit is dishonored, rejected, or otherwise returned as unpaid by the drawee bank, or the item is rejected, or returned by a clearing agent or collecting bank, for any reason, including, but not limited to, issues relating to the quality of the image, you agree that an original check will not be returned to you, but that we may charge back the amount of the original check and provide you with an image of the original check, a paper reproduction of the original check or a substitute check. You will reimburse us for all loss, cost, damage or expense caused by or relating to the processing of the returned item. Without our approval, you shall not attempt to deposit or otherwise negotiate an original check if it has been charged back to you.

We may debit any of your accounts to obtain payment for any item that has been rejected or returned, for any adjustment related to such item or for any warranty claim related to such item, whether or not the rejection, return, adjustment or warranty claim was made timely.

Member Eligibility

You understand that you must be a Acadia Federal Credit Union member in good standing, and meet other pre-determined qualifying factors to qualify for the services. To determine if you are eligible for these Services, visit any AFCU branch or contact the Support Center at 855-692-2234.

Access

To use Mobile Remote Deposit, you must have a compatible mobile device with our system, access to telecommunication services necessary for the Mobile Remote Deposit service. Application upgrades may be required from time-to-time for continued use of the services.

Equipment or System Failure

In the event of a system failure, you agree that, in order to deposit your checks, you must deliver them directly to a Credit Union branch office for processing. If the checks were scanned prior to the system failure, you must obtain our approval before delivering the checks to a branch office for processing.

Hours of Access

Services are available 24 hours per day, 7 days per week, although some or all services may not be available occasionally due to emergency or scheduled system maintenance. Transmission deadlines and funds availability terms and conditions apply. We agree to post notice of any extended periods of non-availability on the Mobile Remote Deposit and or Credit Union website.

Transmission Deadlines

Transmissions originate from the Credit Union offices in Ogden Utah. Image item deposits initiated through the System before 3 p.m. Eastern Time on a business day are posted to member’s account the same day, subject to funds availability. In the event that we receive an image item from you after 3 p.m. Eastern Time, or on a day that is not a business day, the Image item is considered as received by us at the opening of the next business day. For the Mobile Remote Deposit program a business day is describe as Monday through Friday, except for Federal holidays, and holidays observed by the State of Maine. You are responsible for understanding and building into your transmission schedule the changes in transmission windows required by time changes associated with Daylight Savings Time.

Authorized Users

The Credit Union shall be entitled to rely on the apparent authority of any person who accesses the services using valid member and user login IDs and passwords, including such persons who may not be signers on member’s account. Except as otherwise provided by law, you will indemnify Credit Union and hold it harmless for any loss or expense caused by any person with the apparent authority to access the services. You agree to provide each authorized user a copy of these terms in connection with their use of the services. The Credit Union may elect to verify the authenticity or content of any transmission by placing a call to any authorized signer on your account at our discretion. We may deny your access to the services without prior notice if we are unable to confirm any person’s authority to access the services or if we believe such action is necessary for security reasons.

Security

You understand the importance of your role in preventing misuse of your accounts associated with the Mobile Remote Deposit program, and you agree to promptly examine your paper or electronic statement for each of your Credit Union accounts as soon as you receive it and notify us of any errors in accordance with your Account Membership Agreement. You agree to protect the confidentiality of your accounts and account number and passwords. Data transmitted via the services is encrypted in an effort to provide transmission security. Mobile Remote Deposit utilizes identification technology to verify that the sender and receiver, of transmissions related to the services can be appropriately identified by each other. Notwithstanding our efforts to ensure the services are secure, you acknowledge that the Internet is inherently insecure and that all data transfers, including electronic mail, occur openly on the internet and potentially can be monitored and read by others. We cannot, and do not, warrant that all data transfers utilizing Mobile Remote Deposit, or e-mail transmitted to and from us will not be monitored or read by others. You agree to notify us immediately if you believe any passwords have been lost, stolen, used without your permission, or otherwise compromised. Call us immediately at our Call Center at the number in the contact information section of this agreement.

Use of Services

As a condition to using the services, you agree that you are solely responsible for the use of the Services and that you will use the Services in accordance with this agreement. You agree not to attempt to circumvent the security features of the services or the system or make any improper or unauthorized transfer of funds from accounts via the services or the system. You agree that you are prohibited from engaging in conduct that would violate the proprietary rights of the owner(s) of the system and the services as well as accessing or using the system or the services in any other unauthorized manner. You agree to be liable to the Credit Union and its vendors, for any claims, losses, liabilities, damages, expenses or costs arising as a result of the negligent or intentional misuse of the services or the system by you or your authorized users.

You are prohibited from using the services for any activity that:

Deposit of Original Checks

You agree that no check deposited to the Credit Union shall cause funds to be debited more than once from the account of the maker. You agree that the original check, a duplicate check image, or any copy of the original check or check image will not be deposited by you with the Credit Union (unless we instruct you to do so) or under any circumstances with any other financial institution.

Check Retention Period

You agree that you will preserve the originals of all checks, processed through the services pursuant to this agreement for sixty (60) calendar days after the day of deposit (“Retention Period”). After you receive the “Deposit Successful” message, write “Mobile Deposit” on the check front. The risk of loss due to the unavailability of the original or copy of a check for any reason, during the retention period, shall be exclusively on the member.

Destruction of Original Checks

You will be fully responsible for the destruction of the checks. You agree to use commercially reasonable method(s) to destroy original checks after the required retention period has expired. You agree to destroy and dispose of the original checks with a high degree of care, including selecting and implementing appropriate destruction and disposal procedures. You are required to implement such procedures to ensure that the original checks are not accessed by unauthorized persons during the storage, destruction and disposal process and, once destroyed, the original checks are no longer readable or capable of being reconstructed (e.g., through the use of competent shredding equipment). The risk of loss associated with the accidental inclusion of a physical check in the check collection process or with a lost, destroyed, stolen or misplaced check shall be exclusively on the member.

Member Representations and Warranties

You represent and warrant that all checks transmitted through the use of the services are made payable to the member, all signatures and endorsements on each check are authentic and authorized, and each check has not been altered.

Prohibited Checks

You agree that checks scanned through the use of the services will not;

Endorsement of Checks

You agree to properly endorse each check prior to submitting such check through the use of the services.

Image Quality

You are responsible for inspecting and verifying the quality of the images associated with image items, thus ensuring that the digitized images of the front and back of original checks are legible for all posting and clearing purposes by the Credit Union. Specifically, you are representing and warranting to Credit Union that:

The image item is an accurate representation of all information on the front and back of the original check at the time the original check was converted to an image item, and the image item contains all endorsements from the original check necessary to permit Credit Union to:

Adjustments

Once an image item is captured, the system will display captured encoded fields for your review. You will be required to make corrections to encoding not read or missing from the scanned check, including entering the legal amount of the check. We reserve the right to adjust your deposit after you have submitted it for processing. Adjustments are to correct mistakes in the value of image items deposited, mistakes in encoding, or for missing or illegible image items.

Termination

We are permitted to terminate any or all of the services immediately should you breach any part of this agreement or of the membership agreement. We are also permitted to terminate any or all of the services immediately if we are no longer able to provide such services.

Confidentiality

You acknowledge that we will disclose information to third parties about Your account or the image items you deposit:

NOTE: Items deposited using Mobile Remote Deposit is subject to our verification and final inspection process. We may at any time deposit an image item or return all or part of a deposit of multiple image items to you without prior notice. We are under no obligation to inspect or verify any image item to determine accuracy, legibility or quality of the image item or MICR line information associated with the image item, or for any other purpose. However, we may correct or amend MICR line information associated with an image item to facilitate processing of the image item or a substitute check created from that image item. We may process and collect an image item or a substitute image item through one or more check clearing houses, Federal Reserve Banks, or other private clearing agreements with other financial institutions. We may hold and use funds in any deposit account of yours following termination of this Agreement and the services for such time as we reasonably determine to be necessary for us to be assured that no image item processed by us prior to termination may be returned, charged back, or otherwise become a source or cause for any loss, liability, cost, exposure or other action for which the Credit Union may be responsible, with such right being in addition to any other rights we may have with respect to your accounts. Without limitation, you recognize that under the Rules, the UCC, Regulation CC and the rules of any image exchange network, our representations and warranties to others with regards to image items and substitute checks may expose the Credit Union to claims for several years following processing of any particular image item or substitute check.

Items may be returned as image items, rather than substitute checks, as agreed by the parties. If a payor financial institution or other third party makes a claim against us or seeks a recredit with respect to any image item processed, we may provisionally freeze or hold aside a like amount in the applicable account pending investigation and resolution of the claim;

Contact Information

Notifications required by this agreement are to be directed to us at the address or phone numbers listed below.

Acadia Federal Credit Union

9 East Main St., Fort Kent, ME 04743

Toll Free: 855-692-2234

Disclaimer of Warranty and Limitation of Liability

We make no warranty of any kind, express or implied, including any implied warranty of merchantability or fitness for a particular purpose, in connection with the Mobile Remote Deposit Services provided to you under this agreement. We do not and cannot warrant that Services will operate without errors, or that any or all services will be available and operational at all times. Except as specifically provided in this agreement, or otherwise required by law, you agree that our officers, directors, employees, agents or contractors are not liable for any indirect, incidental, special or consequential damages under or by reason of any services or products provided under this and or by reason of your use of or access to Mobile Remote Deposit Services. The Credit Union shall be responsible only for performing the services expressly provided for in this agreement and shall be liable only for its negligence in performing those services. The Credit Union shall not be responsible for the member’s acts or omissions (including without limitation the amount, accuracy, or timeliness of transmittal) or those of any person, including without limitation any Federal Reserve Financial Institution or transmission or communications facility, and no such person shall be deemed the Credit Union’s agent. The member agrees to indemnify the Credit Union against any claims, damages, loss liability, or expense (including attorney’s fees and expense) resulting from or arising out of any claim of any person that the Credit Union is responsible for any act or omission of the member, or any other person described in this paragraph. In no event shall the Credit Union be liable for any consequential, special, punitive or indirect loss or damage which the member may incur or suffer in connection with this Agreement, including without limitation, loss of damage from subsequent wrongful dishonor resulting from the Credit Union’s acts or omissions pursuant to this Agreement. Without limiting the generality of the forgoing provisions, or the provisions of this Agreement, the Credit Union shall be excused from failing to act or from delay in acting if such failure or delay is caused by legal constraint, interruption of transmission or communication facilities, equipment failure, war, emergency conditions or other circumstances beyond the Credit Union’s control. In addition, the Credit Union shall be excused from failing to transmit or delay in transmitting a deposit if such transmittal would result in the Credit Union violating any provision of any present or future risk control program of the Federal Reserve or any rule or regulation of any other United States governmental regulatory authority. Notwithstanding any other provision set forth herein to the contrary, in the event of default under the terms of this agreement by the member, the Credit Union shall have all rights and remedies available at law or in equity.

Governing Law

This Agreement shall be construed in accordance with Maine law and the laws of the United States of America. We and you agree that jurisdiction over, and venue in any legal proceeding arising out of or relating to this agreement, will exclusively be in the state or federal courts located in Fort Kent Maine .

Severability

If any provision of this agreement is held to be illegal, invalid or unenforceable under present or future laws, the remaining provisions shall remain in full force and effect.

Acceptance

Your use of the services constitutes your acceptance of this agreement. The credit union reserves the right to change the terms for the services described in this agreement by notifying you of such change in writing and we may amend, modify, add to, or delete from this agreement from time to time. Your continued use of the services will indicate your acceptance of the revised agreement.